Do-It-Yourself Creditworthiness

Understanding the process, having the tools and making the time.

As you know, having strong creditworthiness is critical for a number of reasons. inVIVO credit’s core purpose is to assist consumers like you with the process of building and maintaining strong creditworthiness and part of that entails making sure you know that building and maintaining strong creditworthiness is something you can do on your own. It is very much like maintaining your pool or yard; it takes knowledge, tools and time. Some people will hire professionals to take care of the service and some people prefer to do it on their own.

Another important point that needs to be understood is that there are no guarantees as to the outcome of many item disputes. We have a very good bearing in this industry because it’s our business; we know where to start in order to get your credit score moving in the right direction but there may be items on your reports that cannot be altered or removed because of their legitimacy. This is precisely why we focus on a broader plan and over time, we are able to achieve very good results. This is also why we offer for no cost, the inVIVO for life lifetime membership. No matter what is on your credit reports, they will always come off at some point when factoring in time. The lifetime membership costs you nothing and it allows us to keep chipping away at existing items left on your reports as well as any new items that may have dropped onto your reports and eventually, they come off.

Nevertheless, if you prefer to work on your creditworthiness yourself, we want to lay out some points of focus. Remember, once achieved, strong creditworthiness comes more from good habits and responsibly managing your cash and debts than anything else:

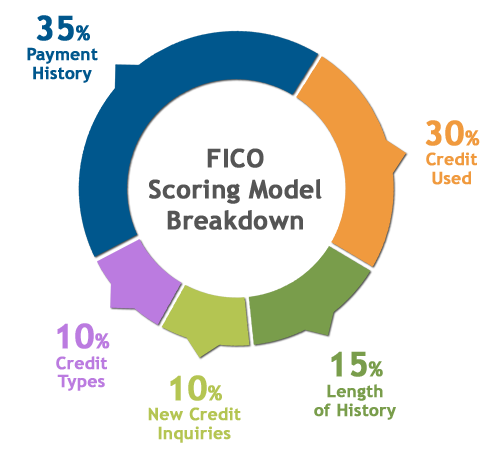

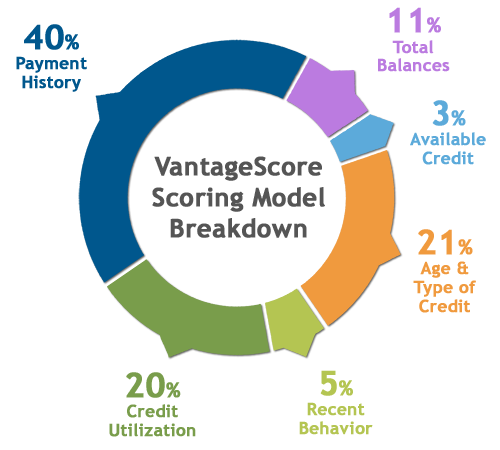

Main Scoring Model Breakdowns

FICO uses 5 key scoring factors; VantageScore uses 6 key scoring factors.